Good morning #Chamber World! It's going to be a GREAT day!

Chamber interest: Chicago Fed Automotive Outlook Symposium: Economy to Cruise Near Speed Limit in 2017 and 2018 Even as Auto Sales Downshift

Chamber interest: Chicago Fed Automotive Outlook Symposium: Economy to Cruise Near Speed Limit in 2017 and 2018 Even as Auto Sales Downshift

According to participants in the Chicago Fed’s annual Automotive Outlook Symposium, the nation’s economic growth is forecasted to be near its long-term average this year and to strengthen somewhat in 2018. Inflation is expected to increase in 2017 and to hold steady in 2018. The unemployment rate is anticipated to edge lower to 4.4% by the end of 2017 and to remain at that rate through 2018. Light vehicle sales are predicted to decrease from 17.5 million units in 2016 to 17.1 million units in 2017 and then to 16.9 million units in 2018.

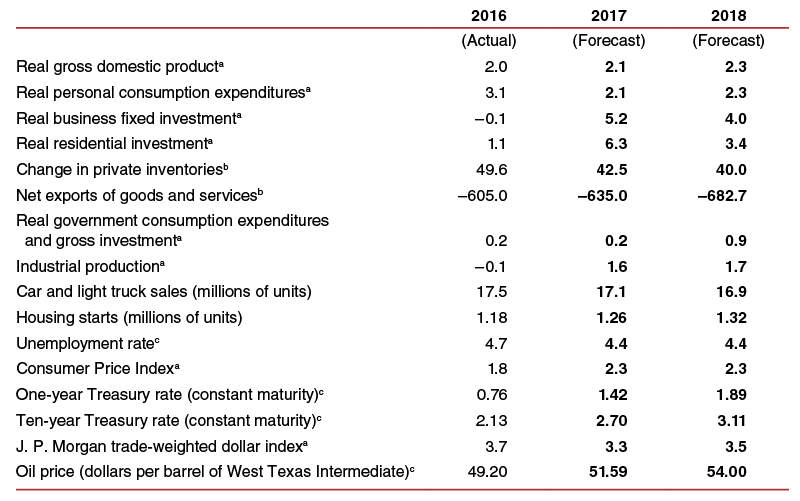

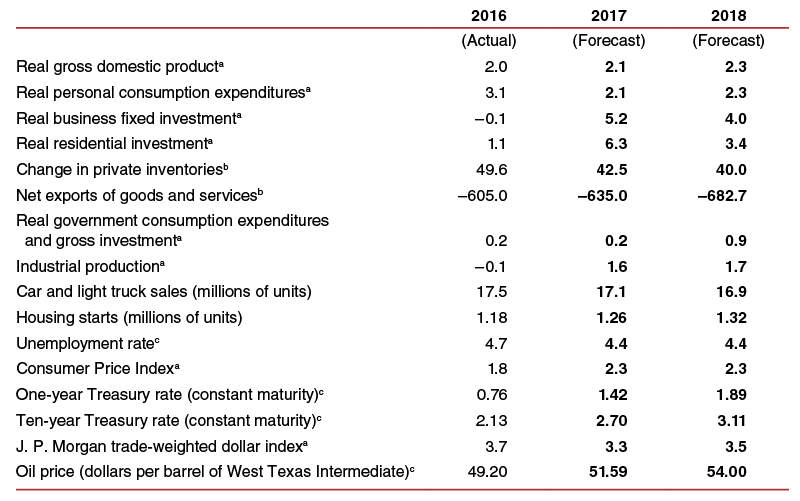

The Federal Reserve Bank of Chicago held its 24th annual Automotive Outlook Symposium (AOS) on June 1–2, 2017, at its Detroit Branch. More than 60 economists and analysts from business, academia, and government attended the AOS. This Chicago Fed Letter reviews the forecasts from last year’s AOS for 2016, and then analyzes the forecasts for 2017 and 2018 (see figure 1) and summarizes the presentations from this year’s AOS.1

Some materials presented at this year’s AOS are available here.

The U.S. economy continued to expand from the longest and deepest drop in economic activity since the Great Depression. During the 31 quarters following the end of the Great Recession in mid-2009, the annualized rate of real gross domestic product (GDP) growth was 2.1%—near what is considered the long-term rate of growth for the U.S. economy. This GDP growth rate is very disappointing, since typically, the pace of economic recovery/expansion is quite sharp following a deep recession.

While the economy’s expansion has lasted nearly eight years, signs of slack still remain in the economy. The unemployment rate moved down to 4.3% in May 2017, below prominent estimates of the natural rate of unemployment (i.e., the rate that would prevail in an economy making full use of its productive resources). However, several other labor market indicators suggest that some degree of slack remains in the employment market. First, the labor force participation rate has fallen over the past several years somewhat below what demographic changes of an aging population can explain. Second, the percentage of workers who are working at part-time jobs but desire full-time employment is still above what it has historically averaged. And third, the pool of unemployed workers who have been out of work for more than six months remains at levels that are exceptionally high—higher than anything seen since the Great Depression.

aPercent change, fourth quarter over fourth quarter.

bBillions of chained (2009) dollars in the fourth quarter at a seasonally adjusted annual rate.

cFourth quarter average.

Note: These values reflect forecasts made in May 2017.

Sources: Actual data from authors’ calculations and Haver Analytics; median forecasts from Automotive Outlook Symposium participants.

In addition to the persistent slack, there have been two big shocks whose effects have reverberated across the U.S. economy over the past three years. First, the average price of oil, which stood at $106 per barrel in June 2014, collapsed later that year, reaching $59 per barrel in December 2014. The average price of oil eventually bottomed out in February 2016—at $31 per barrel. As of May of this year, it had risen to nearly $49 per barrel. The decline in energy prices has had both positive and negative impacts on the U.S. economy. On the positive side, users of energy have enjoyed a substantial reduction in their costs of purchasing energy. The primary beneficiaries have included consumers, manufacturers, and the transportation sector. However, over the past nine years, the United States has become a significantly larger producer of energy, and hence, the loss of income to the domestic energy sector now leads to a greater negative impact than it historically has.

Second, the real value of the U.S. dollar in international exchange markets had strengthened substantially since the summer of 2014, rising nearly 22% through January 2017. The real trade-weighted value of the U.S. dollar fell 3.4% over the following four months, but remained strong. The higher value of the U.S. dollar against foreign currencies has had a dramatic impact on trade and, hence, the U.S. economy’s growth. A strengthening dollar makes U.S.-made goods more expensive to foreign customers, thus reducing the demand for such goods from abroad and lowering the growth of exports. It also makes foreign-made goods less expensive to U.S. purchasers, thus increasing the demand for such goods here and raising the growth of imports. So, given the significantly stronger dollar, it’s no surprise that the United States saw its trade deficit increase in 2016, amounting to a 0.2 percentage point drag on the growth rate of real GDP.

With the diminishing slack in the economy and higher energy prices over the past year, inflation has moved higher. Inflation, as measured by the Consumer Price Index (CPI), was extremely low at 0.4% in 2015—the lowest rate since 1955; it moved up to 1.8% in 2016, and by May 2017, the year-over-year rate of inflation had inched up to 1.9%.

The growth rate of industrial output was –0.1% in 2016, perhaps in part due to the challenges posed by a stronger dollar. However, industrial production does appear to be rising in 2017: Over the first five months of this year, its annualized growth rate was 2.8%. The improvement in industrial output is occurring without much assistance from the automotive sector. Light vehicle sales (car and light truck sales) improved from 17.3 million units in 2015 to a record 17.5 million units in 2016—a 0.7% gain. This increase in light vehicle sales was much smaller than the 3.1% increase in real personal consumption expenditures for 2016. Light vehicle sales softened in early 2017: The annualized selling rate of light vehicles was 17.0 million units over the first five months of this year.

The housing sector continued its very slow recovery from the Great Recession. Housing starts went up from 1.11 million units in 2015 to 1.18 million units in 2016—a gain of 6.3%. Housing starts rose further in 2017, to an annualized rate of 1.19 million units over the first five months of the year. This pace is still well below the nearly 1.4 million annual housing starts that the United States averaged during the 1990s. Residential investment normally plays a major role during an economic recovery. However, since the start of the recovery from the Great Recession in mid-2009, residential investment has contributed just 0.2 percentage points toward the overall economy’s annualized growth rate of 2.1%.

The housing sector is predicted to continue to improve over the forecast horizon. Real residential investment is anticipated to expand at a strong rate of 6.3% in 2017 and then moderate to a solid rate of 3.4% in 2018. Housing starts are expected to increase to 1.26 million units in 2017 and 1.32 million units in 2018—still below what is viewed as their long-term trend.

The long-term interest rate (ten-year Treasury rate) is forecasted to increase 57 basis points in 2017, to 2.70%, and 41 basis points in 2018, to 3.11%. The short-term interest rate (one-year Treasury rate) is expected to increase 66 basis points this year, to 1.42%, and 47 basis points next year, to 1.89%. The trade-weighted U.S. dollar is predicted to strengthen by 3.3% this year and 3.5% in 2018. The trade deficit (net exports of goods and services) is projected to increase this year and next.

Focusing on the U.S. auto market, Teolis said he expected new vehicle sales to shift down modestly from 17.9 million units in 2016 to their long-run historical trend in the coming years. Pent-up demand for new vehicles—which has been a significant stimulus for sales growth—is largely exhausted and is not anticipated to be a major driver for sales over the short term. Rising new vehicle prices will be a deterrent to sales. Additionally, Teolis noted that an increased supply of off-lease used vehicles should push used vehicle prices lower relative to new vehicle prices. However, Teolis said he sees low interest rates, low gas prices, and growing household disposable income as potentially offsetting factors that could prop up new vehicle sales. The prevailing risks to the U.S. auto market over the next few years include a negative correction to the U.S. stock market, trade protectionism, and a strong dollar, he stated.

Light vehicle sales are expected to decline to 17.1 million units in 2017 and then ease further to 16.9 million units in 2018.

Steven Szakaly, chief economist, National Automobile Dealers Association, discussed the light vehicle market from the dealers' perspective. Szakaly primarily addressed the macroeconomic factors affecting dealerships’ new vehicle sales. Because many individuals purchase new vehicles after purchasing a home or starting a family, both the slowdown in household formation and the increase in average age at marriage have contributed negatively to new vehicle sales. Szakaly also noted that the growth of average hourly earnings has not kept pace with the growth of new vehicle prices. According to Szakaly, 17.1 million new light vehicle sales are expected in 2017, followed by a gradual decline in sales through 2020. These projections are largely in line with the median consensus forecast of the AOS.

Charles Chesbrough, senior economist and senior director of industry insights, Cox Automotive, discussed his outlook on the U.S. used light vehicle market. Year-to-date sales of used vehicles are up over 4% from the previous year. What is driving up used vehicle sales? According to Chesbrough, the primary influence has been an increase in the availability of automotive credit. Auto loan debt, which currently stands at about $1.1 trillion, has increased as a share of total debt since the start of the recovery from the Great Recession. Chesbrough said this increase may be partly due to the low default rate on auto loans (relative to first mortgages and other consumer credit) during the downturn and its immediate aftermath. Overall auto loan performance since 2007 suggests issuing such loans is a fairly safe avenue for lending from the financial services sector’s perspective, he indicated. In addition, the low rate of unemployment and the recent increases in job openings and quit rates indicate favorable labor market conditions—which generally support more vehicle sales (new and used) and low default rates on auto loans. However, Moody’s has forecasted increases in auto loan delinquency rates, the quality of auto loans has decreased (e.g., subprime loans have increased), and signs of tightening financial conditions are emerging. Chesbrough said he wonders whether current labor market conditions will hold up much longer, and observed that the annual percentage increase in average hourly earnings has yet to pick up to pre-recessionary levels.

Chesbrough also elaborated on the risks that used light vehicles pose to the new light vehicle market. Between 2010 and 2016, the leased share of all new vehicle registrations rose. He said that leased vehicles return to dealers with lower prices than new vehicles, making them more attractive to consumers. The flood of off-lease vehicles has a negative impact on the residual values of these used autos. According to IHS Markit’s estimates, the annual volume of off-lease vehicles returning to all manufacturers will jump from about 3.1 million units in 2016 to 3.6 million in 2017 and 3.9 million in 2018. In addition, Chesbrough said the lengths of auto loan terms (for both new and used vehicles) have increased (to keep monthly payments low)—which implies future vehicle sales will likely be reduced. High lease rates and long loan terms will be headwinds for all automotive sales over the next few years, he contended.

Kenny Vieth, president, Americas Commercial Transportation (ACT) Research Co. LLC, discussed his outlook for the commercial vehicle (heavy- and medium-duty trucking) industry. Vieth observed that orders for heavy-duty trucks rose considerably since the final quarter of 2016. New order activity is perhaps being supported by recent improvements in manufacturing activity and the jump in the number of oil rigs (they just about doubled from 2016:Q4 to 2017:Q1). However, Vieth pointed out that new heavy-duty truck orders have historically followed increases in freight volume and profits, and neither has suggested this spike in new orders should have happened. For instance, over the first three months of 2017, the American Trucking Associations’ truck loads index has increased by only 0.1%. Thus, Vieth said his guess is that the main driver of order activity has been overconfidence. The National Federation of Independent Business’s Small Business Optimism Index and the Dow Jones U.S. Trucking Index had experienced large gains since November 2016, though both saw dips in May, said Vieth. Meanwhile, the medium-duty market has seen steady incremental improvement, Vieth noted, based on improvements in state and local government budgets and construction activity (especially for home building). According to Vieth, heavy-duty truck production in North America is forecasted to remain at 228,000 units in 2017 and jump to 265,000 units in 2018; and medium-duty truck production in the region is expected to increase from 233,000 units in 2016 to 245,000 units in 2017 and then to 248,000 units in 2018.

John Graham, dean and professor, Indiana University School of Public and Environmental Affairs, summarized his analysis2 of the economic impact of the federal corporate average fuel economy (CAFE) standards; federal greenhouse gas (GHG) emissions standards; and California’s zero-emission vehicle (ZEV) requirements, which some other states have adopted.3 To begin, Graham highlighted the challenges to the implementation of the federal standards because the fuel economy and emissions targets were set in 2012. Since then, oil prices have collapsed, and they are forecasted to remain low over the long term. Graham said his analysis suggests that gas price drops tend to diminish the appeal of electric (or hybrid) vehicles to consumers, in part because when fuel prices are low, it takes longer to recoup the price premium on such vehicles. Moreover, prices on all light vehicles (even those that are not electric or hybrid) are expected to rise as CAFE and GHG emissions standards become more stringent over time. Graham explained that the state-level ZEV requirements, set to go into effect in 2018, require electric vehicle sales in the states that have adopted these rules to be above a particular share of total vehicle sales; therefore, these requirements are expected to further raise electric vehicles’ price premiums. Graham said that state-level ZEV regulations, which are stricter than the federal ones, will end up costing manufacturers and consumers even more.

Given the change in conditions from when fuel efficiency and emissions targets were set, what are the anticipated impacts of the federal and state regulations on the U.S. economy? The aforementioned increases in price premiums translate into decreases in new vehicle sales. Graham noted that current conditions and forecasts suggest a negative impact on such sales, perhaps as far out as through 2035. Lower vehicle sales are presumed to negatively impact employment for those in the auto industry. In contrast, positive impacts from implementing the targets may arise through alternative channels. For example, the targets incentivize manufacturers to invest in new off-cycle technologies (e.g., better automated engine start–stop systems, which reduce engine idling time)—which could generate jobs. Graham said his research suggests, on net, implementing the targets results in a temporary fall in employment, eventually followed by an increase in employment around 2025.The targets also lead to lower expenditures on gasoline, which may translate into consumption of other goods and services. Given their net effect on the economy at least though the mid-2020s, Graham contended reforms to the regulations may be in order. For instance, federal compliance targets for CAFE and GHG emissions currently need to be met by 2025, but regulators could stretch those out to a later date to ease their negative economic impacts on auto manufacturers and consumers, he said.

Christy Gillenwater Named ICEA 'Executive of the Year'

Ferguson's new headquarters project boosts Peninsula's tech jobs sector

The Peninsula’s information technology sector is set to grow in Newport News.

Ferguson Enterprises plans to invest $82.8 million to build a new headquarters at City Center at Oyster Point. The project will keep more than 1,000 jobs in Virginia and create more than 400 new positions.

Gov. Terry McAuliffe made the announcement June 5 in a packed meeting room at the Newport News Marriott at City Center. Newport News Mayor McKinley Price and other elected officials and business leaders also were on hand.

Construction on the new building is expected to begin in 2018. Ferguson will maintain its presence near Newport News/Williamsburg International Airport.

McAuliffe approved a $2 million grant from the commonwealth’s Opportunity Fund to assist Newport News with the project.

“It’s easier to keep a business and have them expand,” McAuliffe said.

The governor touted Virginia as a business friendly state with low taxes, strong workforce and a good quality of life. However, along with all the good news, the governor did express a concern.

“The one thing I worry about every day is we’ve got a lot of open jobs in Virginia,” McAuliffe said. “We’re not a state that is worried about jobs – we have too many that we can’t fill.”The governor said Virginia’s available positions include about 36,000 cyber jobs, which have starting pay around $88,000.

The investment and retention of jobs is significant, said Todd Haymore, Virginia’s Secretary of Commerce and Trade. He said more than 65 percent of job creation in Virginia comes from the expansion of existing industries.

Not only did Ferguson look around the country to find the ideal community for the expansion, “they did deep dives into the workforce and it’s very clear to everyone involved that Virginia has a talented workforce that’s ready to go,” Haymore said.

Mike Kuhns, president and CEO of the Virginia Peninsula Chamber of Commerce, said Ferguson’s commitment to expand in Hampton Roads positions the Peninsula as a diverse technology hub.

“I think the expansion can be a catalyst for IT growth on the Peninsula and may help in the continued development of the technology corridor between ... the City Center area and NASA Langley and (the National Institute of Aerospace),” Kuhns said in an email.

IT sector growth also is “exactly what we need to attract transitioning service members” who are leaving the military with “skills and other formidable attributes that can enhance the quality of our workforce while generally increasing our millennial population.” Read more: The Hampton Roads Business Journal

Birmingham Bloomfield 2016-2017 Membership Directory and Community Resource Guide

The Birmingham-Bloomfield 2016-2017 Membership Directory and Community Resource Guide is available at the Birmingham-Bloomfield Chamber of Commerce today! Thank you to Joe Bauman and the Chamber team for their help and direction putting this together!

Town Square Publications (www.townsquarepublications.com) can help you accomplish your chamber's gloss map, directory, community profile or publication needs at no expense to the chamber. Please email John Dussman at jdussman@tspubs.com or call (847)-427-4633.

#BestChamber Practices: Rochester Regional Chamber: Digital Wednesday Workshop

Join us on Wednesday, July 12 for a workshop presented by George Horrigan from RevLocal. George will be presenting tips and information on how to improve your overall online presence. More than ever, small businesses need help and have questions about digital marketing. George will be answering you questions about digital marketing and social media.

NO FEE TO ATTEND-SEATING IS LIMITED

This event will be held at the Chamber Office

Reserve Your Spot Online

Chamber interest: - 2017 Wisconsin Business Achievement Award and a $75,000 donation - Presented by the Flowers Family Foundation

The Flowers Family Foundation will award the fourth annual Wisconsin Business Achievement Award on October 19, 2017 to honor the recipient for its positive impact on the Wisconsin Economy.

The award not only recognizes the winner for supporting the Wisconsin economy, it also includes a donation made to Wisconsin-based 501(c)3 organization of the award winner’s choice. The 2017 award includes a $75,000 donation.

Hopefully, the publicity, the award and the philanthropic donation will encourage others.

Candidates can be an:

Individual

Partnership

Corporation

Association

Organization

Industry

Educational Institution

Activities can include:

Exports

Inventions

Developing Technology

Products or Services

Excellence in Organization

Creating or Improving a Product

Industry or Profession

Educates Leads

Communicate

APPLY TODAY

NOMINATE TODAY!

An extraordinary opportunity to honor a candidate for their positive impact on the Wisconsin economy & assist a non-profit in a meaningful way. Nominate a candidate by clicking here for the online application. If you prefer a PDF format click here. PDF format nominations should be returned via email to: info@flowersfamilyfoundation.com or via mail to:

Flowers Family Foundation, Inc.

2364 Jackson St., #308

Stoughton, WI 53589

by August 1, 2017

Questions: Contact June Bunting at 608.873.4378

2017 Selection Committee

WMC President/CEO : Kurt R. Bauer

UW System Board of Regents President : Regina Millner

Media Representative The Wall Street Journal : Allysia Finley

View and Print our Brochure

Kentucky Chambers of Commerce Lead National Awards Race

Frankfort, Ky. –The Association of Chamber of Commerce Executives (ACCE), a national organization that represents 1,300 chambers of commerce and the 7,000 chamber professionals who manage chambers of commerce, and the Kentucky Chamber of Commerce Executives (KCCE), released data today showing which shows Kentucky leads the country in both national Chamber of the Year award finalists and winners.

“To have 14 finalists and six winners shows just how effective and professional our business advocacy institutions are here in the Commonwealth,” said Amy Cloud, Executive Director of KCCE.

Since 2007, ACCE has annually recognized chambers of commerce in various size categories for their work leading businesses and communities with the Chamber of the Year award. The award recognizes excellence in operations, member services, and community leadership among chambers of similar size characteristics.

“The chambers in Kentucky share openly with each other, producing a ready supply of best practice models and collective wisdom,” said ACCE President Mick Fleming. “ACCE certainly has more member representation in states larger than Kentucky, meaning that the concentration of excellence in the Bluegrass State is truly remarkable and KCCE’s work is commendable.”

Past winners have included Commerce Lexington in 2016, Murray-Calloway County Chamber in 2012, thePaducah Chamber of Commerce in 2011, the Greater Owensboro Chamber of Commerce in 2010, the Bowling Green Chamber of Commerce in 2009, and Greater Louisville Inc. in 2007.

Members look to ACCE for best practices, networks and new ideas. ACCE recommends successful programs and strategies, and identifies trends, partners and business models that show promise.

About ACCE:

The Association of Chamber of Commerce Executives (ACCE) serves professionals who manage chambers of commerce. ACCE's mission is to support and develop these chamber leaders to advance the interests of their communities and businesses. Follow on Twitter: @ACCE_updates.

About KCCE:

Kentucky Chamber of Commerce Executives (KCCE) is the professional development society for local chambers of commerce in Kentucky. Established in 1965, it is a not-for-profit division of the Kentucky Chamber of Commerce, and its primary goal is to serve its membership. Follow us on Twitter: @KyExecs

West Town Chamber of Commerce - Announcing West Fest 2017 July 7th, 8th & 9th

What makes West Fest so unique? Since 2004 West Fest stands out from the rest because it is locally planned and managed by the West Town Chamber of Commerce emphasising local offerings and local talent, reflecting the eclectic West Town community. West Fest features neighborhood retailers, restaurants, fine artists, and crafters. West Fest is known not only for cutting edge live music but as the first street festival to feature a DJ stage.

West Fest's Chicago House DJ Stage

2017 Sponsors

For more information, call 312-850-9390 or visit www.westfestchicago.com. Be sure to like West Fest on Facebook at facebook.com/westfestchicago.

#westfestchicago #westfestbestfest

The Federal Reserve Bank of Chicago held its 24th annual Automotive Outlook Symposium (AOS) on June 1–2, 2017, at its Detroit Branch. More than 60 economists and analysts from business, academia, and government attended the AOS. This Chicago Fed Letter reviews the forecasts from last year’s AOS for 2016, and then analyzes the forecasts for 2017 and 2018 (see figure 1) and summarizes the presentations from this year’s AOS.1

Some materials presented at this year’s AOS are available here.

The U.S. economy continued to expand from the longest and deepest drop in economic activity since the Great Depression. During the 31 quarters following the end of the Great Recession in mid-2009, the annualized rate of real gross domestic product (GDP) growth was 2.1%—near what is considered the long-term rate of growth for the U.S. economy. This GDP growth rate is very disappointing, since typically, the pace of economic recovery/expansion is quite sharp following a deep recession.

While the economy’s expansion has lasted nearly eight years, signs of slack still remain in the economy. The unemployment rate moved down to 4.3% in May 2017, below prominent estimates of the natural rate of unemployment (i.e., the rate that would prevail in an economy making full use of its productive resources). However, several other labor market indicators suggest that some degree of slack remains in the employment market. First, the labor force participation rate has fallen over the past several years somewhat below what demographic changes of an aging population can explain. Second, the percentage of workers who are working at part-time jobs but desire full-time employment is still above what it has historically averaged. And third, the pool of unemployed workers who have been out of work for more than six months remains at levels that are exceptionally high—higher than anything seen since the Great Depression.

1. Median forecast of GDP and related items

bBillions of chained (2009) dollars in the fourth quarter at a seasonally adjusted annual rate.

cFourth quarter average.

Note: These values reflect forecasts made in May 2017.

Sources: Actual data from authors’ calculations and Haver Analytics; median forecasts from Automotive Outlook Symposium participants.

In addition to the persistent slack, there have been two big shocks whose effects have reverberated across the U.S. economy over the past three years. First, the average price of oil, which stood at $106 per barrel in June 2014, collapsed later that year, reaching $59 per barrel in December 2014. The average price of oil eventually bottomed out in February 2016—at $31 per barrel. As of May of this year, it had risen to nearly $49 per barrel. The decline in energy prices has had both positive and negative impacts on the U.S. economy. On the positive side, users of energy have enjoyed a substantial reduction in their costs of purchasing energy. The primary beneficiaries have included consumers, manufacturers, and the transportation sector. However, over the past nine years, the United States has become a significantly larger producer of energy, and hence, the loss of income to the domestic energy sector now leads to a greater negative impact than it historically has.

Second, the real value of the U.S. dollar in international exchange markets had strengthened substantially since the summer of 2014, rising nearly 22% through January 2017. The real trade-weighted value of the U.S. dollar fell 3.4% over the following four months, but remained strong. The higher value of the U.S. dollar against foreign currencies has had a dramatic impact on trade and, hence, the U.S. economy’s growth. A strengthening dollar makes U.S.-made goods more expensive to foreign customers, thus reducing the demand for such goods from abroad and lowering the growth of exports. It also makes foreign-made goods less expensive to U.S. purchasers, thus increasing the demand for such goods here and raising the growth of imports. So, given the significantly stronger dollar, it’s no surprise that the United States saw its trade deficit increase in 2016, amounting to a 0.2 percentage point drag on the growth rate of real GDP.

With the diminishing slack in the economy and higher energy prices over the past year, inflation has moved higher. Inflation, as measured by the Consumer Price Index (CPI), was extremely low at 0.4% in 2015—the lowest rate since 1955; it moved up to 1.8% in 2016, and by May 2017, the year-over-year rate of inflation had inched up to 1.9%.

The growth rate of industrial output was –0.1% in 2016, perhaps in part due to the challenges posed by a stronger dollar. However, industrial production does appear to be rising in 2017: Over the first five months of this year, its annualized growth rate was 2.8%. The improvement in industrial output is occurring without much assistance from the automotive sector. Light vehicle sales (car and light truck sales) improved from 17.3 million units in 2015 to a record 17.5 million units in 2016—a 0.7% gain. This increase in light vehicle sales was much smaller than the 3.1% increase in real personal consumption expenditures for 2016. Light vehicle sales softened in early 2017: The annualized selling rate of light vehicles was 17.0 million units over the first five months of this year.

The housing sector continued its very slow recovery from the Great Recession. Housing starts went up from 1.11 million units in 2015 to 1.18 million units in 2016—a gain of 6.3%. Housing starts rose further in 2017, to an annualized rate of 1.19 million units over the first five months of the year. This pace is still well below the nearly 1.4 million annual housing starts that the United States averaged during the 1990s. Residential investment normally plays a major role during an economic recovery. However, since the start of the recovery from the Great Recession in mid-2009, residential investment has contributed just 0.2 percentage points toward the overall economy’s annualized growth rate of 2.1%.

Results versus forecasts

For 2016, the actual growth rate of real GDP was 2.0%—just a bit stronger than the 1.8% forecasted by participants at last year’s AOS. The unemployment rate actually averaged 4.7% in the final quarter of 2016—lower than the predicted average of 4.9%. Inflation, as measured by the CPI, was in fact 1.8% in 2016—0.6 percentage points higher than the projected 1.2% increase in prices for last year. Light vehicle sales actually rose to 17.5 million units in 2016, exceeding the forecast of 17.3 million units. Housing starts increased to 1.18 million units in 2016—the actual number of starts was just a bit above the 1.17 million units expected for last year.Outlook for 2017 and 2018

The economy is forecasted to grow at a solid pace in 2017 and at a slightly faster pace in 2018: The growth rate of real GDP is predicted to be 2.1% in 2017 and 2.3% in 2018. The unemployment rate is predicted to edge lower through the third quarter of 2017 and then remain at a rate of 4.4% through the end of 2018. Inflation, as measured by the CPI, is projected to increase from 1.8% in 2016 to 2.3% in 2017 and then remain at that rate in 2018. Real personal consumption expenditures are forecasted to expand at solid rates of 2.1% this year and 2.3% in 2018. Light vehicle sales are expected to decline from 17.5 million units in 2016 to 17.1 million units this year and then ease further to 16.9 million units next year. The pace of real business fixed investment is predicted to be at a quite strong 5.2% in 2017, but then ease to a still solid 4.0% in 2018. Because of the challenges posed by the stronger dollar, industrial production is forecasted to grow at a rate of just 1.6% this year and 1.7% (well below its long-term growth rate) next year.The housing sector is predicted to continue to improve over the forecast horizon. Real residential investment is anticipated to expand at a strong rate of 6.3% in 2017 and then moderate to a solid rate of 3.4% in 2018. Housing starts are expected to increase to 1.26 million units in 2017 and 1.32 million units in 2018—still below what is viewed as their long-term trend.

The long-term interest rate (ten-year Treasury rate) is forecasted to increase 57 basis points in 2017, to 2.70%, and 41 basis points in 2018, to 3.11%. The short-term interest rate (one-year Treasury rate) is expected to increase 66 basis points this year, to 1.42%, and 47 basis points next year, to 1.89%. The trade-weighted U.S. dollar is predicted to strengthen by 3.3% this year and 3.5% in 2018. The trade deficit (net exports of goods and services) is projected to increase this year and next.

Auto sector outlook

David Teolis, senior manager of economic and industry forecasting, General Motors, provided an outlook for global and U.S. total vehicle sales (passenger cars and light-, medium-, and heavy-duty trucks). Teolis began by describing the global vehicle market: New vehicle sales reached a record high of 93.1 million units in 2016, up 3.8% from the previous year. The majority of these sales were in North American, Asian, and European markets. Despite subpar GDP growth in many parts of the world, manufacturing activity is generally expanding because of the pickup in global trade, said Teolis. Moreover, inflationary pressures appear largely contained for now. However, there continue to be challenges. For instance, declines in commodity prices (including energy prices) have led to lower vehicle sales in many commodity-producing countries. In addition, new vehicle sales growth in the North American Free Trade Agreement (NAFTA) region (of Canada, Mexico, and the U.S.) has outpaced its real GDP growth, suggesting a modest downward correction in new vehicle sales is due, Teolis contended. Yet, Teolis said he envisions strong upside potential for new vehicle sales in India, Brazil, and Mexico.Focusing on the U.S. auto market, Teolis said he expected new vehicle sales to shift down modestly from 17.9 million units in 2016 to their long-run historical trend in the coming years. Pent-up demand for new vehicles—which has been a significant stimulus for sales growth—is largely exhausted and is not anticipated to be a major driver for sales over the short term. Rising new vehicle prices will be a deterrent to sales. Additionally, Teolis noted that an increased supply of off-lease used vehicles should push used vehicle prices lower relative to new vehicle prices. However, Teolis said he sees low interest rates, low gas prices, and growing household disposable income as potentially offsetting factors that could prop up new vehicle sales. The prevailing risks to the U.S. auto market over the next few years include a negative correction to the U.S. stock market, trade protectionism, and a strong dollar, he stated.

Light vehicle sales are expected to decline to 17.1 million units in 2017 and then ease further to 16.9 million units in 2018.

Steven Szakaly, chief economist, National Automobile Dealers Association, discussed the light vehicle market from the dealers' perspective. Szakaly primarily addressed the macroeconomic factors affecting dealerships’ new vehicle sales. Because many individuals purchase new vehicles after purchasing a home or starting a family, both the slowdown in household formation and the increase in average age at marriage have contributed negatively to new vehicle sales. Szakaly also noted that the growth of average hourly earnings has not kept pace with the growth of new vehicle prices. According to Szakaly, 17.1 million new light vehicle sales are expected in 2017, followed by a gradual decline in sales through 2020. These projections are largely in line with the median consensus forecast of the AOS.

Charles Chesbrough, senior economist and senior director of industry insights, Cox Automotive, discussed his outlook on the U.S. used light vehicle market. Year-to-date sales of used vehicles are up over 4% from the previous year. What is driving up used vehicle sales? According to Chesbrough, the primary influence has been an increase in the availability of automotive credit. Auto loan debt, which currently stands at about $1.1 trillion, has increased as a share of total debt since the start of the recovery from the Great Recession. Chesbrough said this increase may be partly due to the low default rate on auto loans (relative to first mortgages and other consumer credit) during the downturn and its immediate aftermath. Overall auto loan performance since 2007 suggests issuing such loans is a fairly safe avenue for lending from the financial services sector’s perspective, he indicated. In addition, the low rate of unemployment and the recent increases in job openings and quit rates indicate favorable labor market conditions—which generally support more vehicle sales (new and used) and low default rates on auto loans. However, Moody’s has forecasted increases in auto loan delinquency rates, the quality of auto loans has decreased (e.g., subprime loans have increased), and signs of tightening financial conditions are emerging. Chesbrough said he wonders whether current labor market conditions will hold up much longer, and observed that the annual percentage increase in average hourly earnings has yet to pick up to pre-recessionary levels.

Chesbrough also elaborated on the risks that used light vehicles pose to the new light vehicle market. Between 2010 and 2016, the leased share of all new vehicle registrations rose. He said that leased vehicles return to dealers with lower prices than new vehicles, making them more attractive to consumers. The flood of off-lease vehicles has a negative impact on the residual values of these used autos. According to IHS Markit’s estimates, the annual volume of off-lease vehicles returning to all manufacturers will jump from about 3.1 million units in 2016 to 3.6 million in 2017 and 3.9 million in 2018. In addition, Chesbrough said the lengths of auto loan terms (for both new and used vehicles) have increased (to keep monthly payments low)—which implies future vehicle sales will likely be reduced. High lease rates and long loan terms will be headwinds for all automotive sales over the next few years, he contended.

Kenny Vieth, president, Americas Commercial Transportation (ACT) Research Co. LLC, discussed his outlook for the commercial vehicle (heavy- and medium-duty trucking) industry. Vieth observed that orders for heavy-duty trucks rose considerably since the final quarter of 2016. New order activity is perhaps being supported by recent improvements in manufacturing activity and the jump in the number of oil rigs (they just about doubled from 2016:Q4 to 2017:Q1). However, Vieth pointed out that new heavy-duty truck orders have historically followed increases in freight volume and profits, and neither has suggested this spike in new orders should have happened. For instance, over the first three months of 2017, the American Trucking Associations’ truck loads index has increased by only 0.1%. Thus, Vieth said his guess is that the main driver of order activity has been overconfidence. The National Federation of Independent Business’s Small Business Optimism Index and the Dow Jones U.S. Trucking Index had experienced large gains since November 2016, though both saw dips in May, said Vieth. Meanwhile, the medium-duty market has seen steady incremental improvement, Vieth noted, based on improvements in state and local government budgets and construction activity (especially for home building). According to Vieth, heavy-duty truck production in North America is forecasted to remain at 228,000 units in 2017 and jump to 265,000 units in 2018; and medium-duty truck production in the region is expected to increase from 233,000 units in 2016 to 245,000 units in 2017 and then to 248,000 units in 2018.

John Graham, dean and professor, Indiana University School of Public and Environmental Affairs, summarized his analysis2 of the economic impact of the federal corporate average fuel economy (CAFE) standards; federal greenhouse gas (GHG) emissions standards; and California’s zero-emission vehicle (ZEV) requirements, which some other states have adopted.3 To begin, Graham highlighted the challenges to the implementation of the federal standards because the fuel economy and emissions targets were set in 2012. Since then, oil prices have collapsed, and they are forecasted to remain low over the long term. Graham said his analysis suggests that gas price drops tend to diminish the appeal of electric (or hybrid) vehicles to consumers, in part because when fuel prices are low, it takes longer to recoup the price premium on such vehicles. Moreover, prices on all light vehicles (even those that are not electric or hybrid) are expected to rise as CAFE and GHG emissions standards become more stringent over time. Graham explained that the state-level ZEV requirements, set to go into effect in 2018, require electric vehicle sales in the states that have adopted these rules to be above a particular share of total vehicle sales; therefore, these requirements are expected to further raise electric vehicles’ price premiums. Graham said that state-level ZEV regulations, which are stricter than the federal ones, will end up costing manufacturers and consumers even more.

Given the change in conditions from when fuel efficiency and emissions targets were set, what are the anticipated impacts of the federal and state regulations on the U.S. economy? The aforementioned increases in price premiums translate into decreases in new vehicle sales. Graham noted that current conditions and forecasts suggest a negative impact on such sales, perhaps as far out as through 2035. Lower vehicle sales are presumed to negatively impact employment for those in the auto industry. In contrast, positive impacts from implementing the targets may arise through alternative channels. For example, the targets incentivize manufacturers to invest in new off-cycle technologies (e.g., better automated engine start–stop systems, which reduce engine idling time)—which could generate jobs. Graham said his research suggests, on net, implementing the targets results in a temporary fall in employment, eventually followed by an increase in employment around 2025.The targets also lead to lower expenditures on gasoline, which may translate into consumption of other goods and services. Given their net effect on the economy at least though the mid-2020s, Graham contended reforms to the regulations may be in order. For instance, federal compliance targets for CAFE and GHG emissions currently need to be met by 2025, but regulators could stretch those out to a later date to ease their negative economic impacts on auto manufacturers and consumers, he said.

Conclusion

The participants at this year’s AOS predicted the growth rate of the U.S. economy to be close to its long-term average in 2017 and 2018. Light vehicle sales are forecasted to ease from a record-setting 17.5 million units in 2016 to a still solid 17.1 million units in 2017 and 16.9 million units in 2018. Although light vehicle sales are forecasted to moderate, other sectors of the economy are predicted to perform well enough so that the overall growth rate improves in 2017 and 2018. Inflation is anticipated to average 2.3% this year and next year. And the unemployment rate is expected to decline to 4.4% by the end of 2017 and stay there through 2018. More information: Chicago FedChristy Gillenwater Named ICEA 'Executive of the Year'

The Indiana Chamber Executives Association has named Christy Gillenwater the 2017 Executive of the Year. Gillenwater is the president and chief executive officer of the Southwest Indiana Chamber and received the honor at the association's annual conference in South Bend.

Gillenwater has served as president and CEO of the chamber since 2013. The association chooses the winner based on criteria including a minimum of three years on the job, demonstration of "long-term exemplary performance and leadership," and demonstrated ability to lead change at the local chamber level. The nomination process includes a brief essay about why the nominee is deserving of the award.

"In the four years that Christy has been at the helm, the Southwest Indiana Chamber has firmly established itself as one of the leading chambers in the Midwest, in large part because of her collaborative spirit and commitment to helping community organizations drive economic development and positive change in our region,” said Southwest Indiana Chamber Board Chairman Jim Sandgren.

The Southwest Indiana Chamber was named the 2015 Chamber of the year in Indiana by the ICEA and the 2016 National Chamber of the Year by the Association of Chamber of Commerce Executives. Read more: Inside Indiana Business

Ferguson's new headquarters project boosts Peninsula's tech jobs sector

The Peninsula’s information technology sector is set to grow in Newport News.

Ferguson Enterprises plans to invest $82.8 million to build a new headquarters at City Center at Oyster Point. The project will keep more than 1,000 jobs in Virginia and create more than 400 new positions.

Gov. Terry McAuliffe made the announcement June 5 in a packed meeting room at the Newport News Marriott at City Center. Newport News Mayor McKinley Price and other elected officials and business leaders also were on hand.

Construction on the new building is expected to begin in 2018. Ferguson will maintain its presence near Newport News/Williamsburg International Airport.

McAuliffe approved a $2 million grant from the commonwealth’s Opportunity Fund to assist Newport News with the project.

“It’s easier to keep a business and have them expand,” McAuliffe said.

The governor touted Virginia as a business friendly state with low taxes, strong workforce and a good quality of life. However, along with all the good news, the governor did express a concern.

“The one thing I worry about every day is we’ve got a lot of open jobs in Virginia,” McAuliffe said. “We’re not a state that is worried about jobs – we have too many that we can’t fill.”The governor said Virginia’s available positions include about 36,000 cyber jobs, which have starting pay around $88,000.

The investment and retention of jobs is significant, said Todd Haymore, Virginia’s Secretary of Commerce and Trade. He said more than 65 percent of job creation in Virginia comes from the expansion of existing industries.

Not only did Ferguson look around the country to find the ideal community for the expansion, “they did deep dives into the workforce and it’s very clear to everyone involved that Virginia has a talented workforce that’s ready to go,” Haymore said.

Mike Kuhns, president and CEO of the Virginia Peninsula Chamber of Commerce, said Ferguson’s commitment to expand in Hampton Roads positions the Peninsula as a diverse technology hub.

“I think the expansion can be a catalyst for IT growth on the Peninsula and may help in the continued development of the technology corridor between ... the City Center area and NASA Langley and (the National Institute of Aerospace),” Kuhns said in an email.

IT sector growth also is “exactly what we need to attract transitioning service members” who are leaving the military with “skills and other formidable attributes that can enhance the quality of our workforce while generally increasing our millennial population.” Read more: The Hampton Roads Business Journal

Birmingham Bloomfield 2016-2017 Membership Directory and Community Resource Guide

The Birmingham-Bloomfield 2016-2017 Membership Directory and Community Resource Guide is available at the Birmingham-Bloomfield Chamber of Commerce today! Thank you to Joe Bauman and the Chamber team for their help and direction putting this together!

Town Square Publications (www.townsquarepublications.com) can help you accomplish your chamber's gloss map, directory, community profile or publication needs at no expense to the chamber. Please email John Dussman at jdussman@tspubs.com or call (847)-427-4633.

#BestChamber Practices: Rochester Regional Chamber: Digital Wednesday Workshop

Join us on Wednesday, July 12 for a workshop presented by George Horrigan from RevLocal. George will be presenting tips and information on how to improve your overall online presence. More than ever, small businesses need help and have questions about digital marketing. George will be answering you questions about digital marketing and social media.

NO FEE TO ATTEND-SEATING IS LIMITED

This event will be held at the Chamber Office

Reserve Your Spot Online

Chamber interest: - 2017 Wisconsin Business Achievement Award and a $75,000 donation - Presented by the Flowers Family Foundation

The Flowers Family Foundation will award the fourth annual Wisconsin Business Achievement Award on October 19, 2017 to honor the recipient for its positive impact on the Wisconsin Economy.

The award not only recognizes the winner for supporting the Wisconsin economy, it also includes a donation made to Wisconsin-based 501(c)3 organization of the award winner’s choice. The 2017 award includes a $75,000 donation.

Hopefully, the publicity, the award and the philanthropic donation will encourage others.

Candidates can be an:

Individual

Partnership

Corporation

Association

Organization

Industry

Educational Institution

Exports

Inventions

Developing Technology

Products or Services

Excellence in Organization

Creating or Improving a Product

Industry or Profession

Educates Leads

Communicate

APPLY TODAY

NOMINATE TODAY!

Flowers Family Foundation, Inc.

2364 Jackson St., #308

Stoughton, WI 53589

by August 1, 2017

Questions: Contact June Bunting at 608.873.4378

2017 Selection Committee

WMC President/CEO : Kurt R. Bauer

UW System Board of Regents President : Regina Millner

Media Representative The Wall Street Journal : Allysia Finley

Kentucky Chambers of Commerce Lead National Awards Race

New data reveals state produced most winners in last decade

“To have 14 finalists and six winners shows just how effective and professional our business advocacy institutions are here in the Commonwealth,” said Amy Cloud, Executive Director of KCCE.

Since 2007, ACCE has annually recognized chambers of commerce in various size categories for their work leading businesses and communities with the Chamber of the Year award. The award recognizes excellence in operations, member services, and community leadership among chambers of similar size characteristics.

“The chambers in Kentucky share openly with each other, producing a ready supply of best practice models and collective wisdom,” said ACCE President Mick Fleming. “ACCE certainly has more member representation in states larger than Kentucky, meaning that the concentration of excellence in the Bluegrass State is truly remarkable and KCCE’s work is commendable.”

Past winners have included Commerce Lexington in 2016, Murray-Calloway County Chamber in 2012, thePaducah Chamber of Commerce in 2011, the Greater Owensboro Chamber of Commerce in 2010, the Bowling Green Chamber of Commerce in 2009, and Greater Louisville Inc. in 2007.

Members look to ACCE for best practices, networks and new ideas. ACCE recommends successful programs and strategies, and identifies trends, partners and business models that show promise.

About ACCE:

About KCCE:

Kentucky Chamber of Commerce Executives (KCCE) is the professional development society for local chambers of commerce in Kentucky. Established in 1965, it is a not-for-profit division of the Kentucky Chamber of Commerce, and its primary goal is to serve its membership. Follow us on Twitter: @KyExecs

Chamber's Leadership Class: Parent fair to be part of next baby shower

- Merit Health River Region Services — (OB/Pediatric/EDU)

- Merit Health River Region Breast Feeding /Lactation Services

- Merit Health River Region Formula Preparation

- Child Safety — Travel/Sleep/Home

- Developmental Milestones

- Fatherhood

- Momma Said There Would be Days Like This — postpartum depression, mental health, couples counseling

- Resources for Parenting Classes

- Baby Let’s Move — Healthy Pregnant and Postpartum Mothers

- Creating Lasting Memories

- Prenatal Nutrition — Fit Pregnancy and Baby

- United Way & Excel by 5 -Partner Resource Guide, Early Reading, Growth Charts

West Town Chamber of Commerce - Announcing West Fest 2017 July 7th, 8th & 9th

West Fest, returns for its lucky 13th season with some of the most highly-anticipated live music of the summer. Hailed as one of the top festivals in the city and suburbs by the Chicago Tribune and others, West Fest 2017 features the Main Stage programmed the nationally-renowned Empty Bottle Presents, and as always, a dedicated Chicago House DJ Stage. The annual street fest also boasts some of West Town's most popular boutiques and restaurants, Pet Fest with dog activities for charity, and Kid Fest for family fun.

What makes West Fest so unique? Since 2004 West Fest stands out from the rest because it is locally planned and managed by the West Town Chamber of Commerce emphasising local offerings and local talent, reflecting the eclectic West Town community. West Fest features neighborhood retailers, restaurants, fine artists, and crafters. West Fest is known not only for cutting edge live music but as the first street festival to feature a DJ stage.

The Music

Over the years, West Fest's stellar music lineups have been ranked among the best concerts of the summer (and only at a fraction of the cost!) West Fest 2017's lineup promises to hold true to form, with dozens of original bands and Chicago House DJs over the 3-day weekend.

Empty Bottle Presents Main Stage:

FRIDAY 7/7

8:30 PM ESG

7:00 PM Durand Jones & The Indications

5:30 PM HUJO

SATURDAY 7/8

8:30 PM Speedy Ortiz

7:00 PM Royal Headache

5:30 PM Femdot

4:00 PM Cymbals Eat Guitars

2:45 PM FACS

1:30 PM DEHD

SUNDAY 7/9

8:30 PM Local H

7:00 PM Har Mar Superstar

5:30 PM Palehound

4:00 PM Woods

2:45 PM Post Animal

1:30 PM School of Rock

West Fest's Chicago House DJ Stage

FRIDAY 7/7

7 - 9:30pm Miles Maeda

6- 7pm Dj Lady D

5 - 6pm Andrew Emil

6- 7pm Dj Lady D

5 - 6pm Andrew Emil

SATURDAY 7/8

6:30-9:30pm Mark Farina

5:30-6:30pm Dj Heather

4:30-5:30pm Jevon Jackson

3:30-4:30pm Phantom 45

2:30 -3:30pm Dj Hiroki

1:30-2:30pm Dj Sushi

5:30-6:30pm Dj Heather

4:30-5:30pm Jevon Jackson

3:30-4:30pm Phantom 45

2:30 -3:30pm Dj Hiroki

1:30-2:30pm Dj Sushi

SUNDAY 7/9

8 - 9:30pm Derrick Carter

7 - 8pm Diz

6 - 7pm John Simmons

5 - 6pm John Mörk

4 - 5pm Miguel Martin "EchoDroides - Dj Set"

3 - 4pm Karl & Mark Almaria "Flying Almaria Bros"

2 - 3pm Dj Intel

1 - 2pm Justin Reed

8 - 9:30pm Derrick Carter

7 - 8pm Diz

6 - 7pm John Simmons

5 - 6pm John Mörk

4 - 5pm Miguel Martin "EchoDroides - Dj Set"

3 - 4pm Karl & Mark Almaria "Flying Almaria Bros"

2 - 3pm Dj Intel

1 - 2pm Justin Reed

Kid Fest

Kid Fest runs Saturday and Sunday from 12-7pm on Wolcott between Chicago Ave and Rice St. Kid Fest is organized by and benefits Talcott Fine Arts & Museum Academy and offers quality children and family activities including train rides, bounce houses, an inflatable obstacle course, pony rides, carnival games, kid friendly vendors, and a kid's stage with live family friendly music.

Kid Fest Stage:

SATURDAY 7/8

1-2 pm TBD

2-3 pm ChiME

3-4 pm School of Rock

4-5 pm Mr. Singer

5-6 pm Authentic Pines

6-7 pm TBD

SUNDAY 7/9

1-2 pm TBD

2-4 pm Imagination Project

4-5 pm Mary Macaroni

5-6 pm Miss Jamie from the Farm

6-7 pm Mr. Singer

SATURDAY 7/8

1-2 pm TBD

2-3 pm ChiME

3-4 pm School of Rock

4-5 pm Mr. Singer

5-6 pm Authentic Pines

6-7 pm TBD

SUNDAY 7/9

1-2 pm TBD

2-4 pm Imagination Project

4-5 pm Mary Macaroni

5-6 pm Miss Jamie from the Farm

6-7 pm Mr. Singer

Pet Fest

Pet Fest runs Saturday and Sunday from 12-6pm on Wolcott between Chicago Ave and Superior. Sponsored by Canine Crews, Doggy Style Pet Shop, and Green Dog, Pet Fest features a charity dog wash, dog obstacle course, paw painting, pet retail booths, tie-dye dog bandana making, paddling pools and plenty of water; plus pet related demonstrations throughout the day, pet services booths, local veterinarians, and canine therapists. All proceeds benefit Alive Rescue and One Tail at a Time, and goodie bags for those humans whom donate or purchase.

The Fine Print

There is a $5 donation requested for entry to West Fest. The donation is not required, however everyone entering the site on foot, even residents and patrons going to local businesses, will have to pass through our entrance gates and may have to wait in line and be subject to a bag check due to security measures in place. The West Town Chamber is the primary benefactor and producer of the festival. 20% of the net proceeds from the festival benefit local public schools Talcott Fine Arts and Museum Academy and Mitchell Elementary School. The event location is Chicago Ave between Damen and Wood. (1800-2000 W. Chicago Avenue). Hours of operation are 5pm to 10pm on Friday and are noon to 10pm on Saturday and Sunday. KidFest runs noon to 7pm, and Pet Fest runs noon to 6pm, on only Saturday and Sunday.

Getting There

West Fest takes place on Chicago Avenue between Damen Avenue and Wood Street. The address at Damen and Chicago Avenue is 2000 W. Chicago Avenue for navigational purposes. There is FREE Bike Parking at West Fest and the event is easily accessible by public transportation via the #66 CTA Chicago Avenue BUS and/or the closest El Train stops are the Blue Line at Division Street or at Chicago Avenue. Vehicle street parking nearby the fest is also available.

Getting There

West Fest takes place on Chicago Avenue between Damen Avenue and Wood Street. The address at Damen and Chicago Avenue is 2000 W. Chicago Avenue for navigational purposes. There is FREE Bike Parking at West Fest and the event is easily accessible by public transportation via the #66 CTA Chicago Avenue BUS and/or the closest El Train stops are the Blue Line at Division Street or at Chicago Avenue. Vehicle street parking nearby the fest is also available.

2017 Sponsors

#westfestchicago #westfestbestfest

Good morning #Chamber World! It's going to be a GREAT day!

Town Square Publications Chamber Membership Directories and Community Profiles: The best in the U.S.

Town Square Publications, a division of the Daily Herald Media Group, is a national chamber custom publishing group that specializes in developing partnerships by producing high-quality print and digitally integrated publications along with other added value programs dedicated to creating relevancy for local chambers of commerce and other membership focused organizations interested in raising non-dues revenues.

Town Square Publications parent company, Paddock Publications, has over 100 years’ experience of print product development and dedicated customer service in communities throughout the Midwest. Our experience allows Town Square Publications to offer you attractive royalty and non-dues revenue share streams, provide direct distribution of your custom designed printed publications, including digital and mobile integration, and all with the quickest turn-around times available in the industry. Town Square also offers multi-media maps in both print and online formats, both with our No-Cost guarantee. More information: Town Square Publications

Chambers of Commerce and member focused organizations serve as a valuable resource in the local marketplace. The networking opportunities and representation with a wide variety of diverse businesses in your community is the catalyst of a successful organization. For further information about Town Square's publishing partnership with chambers of commerce and our No-Cost guarantee and Earned Revenue Share Program, To request your chamber publication or map proposal, contact Town Square Chamber Proposal

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.